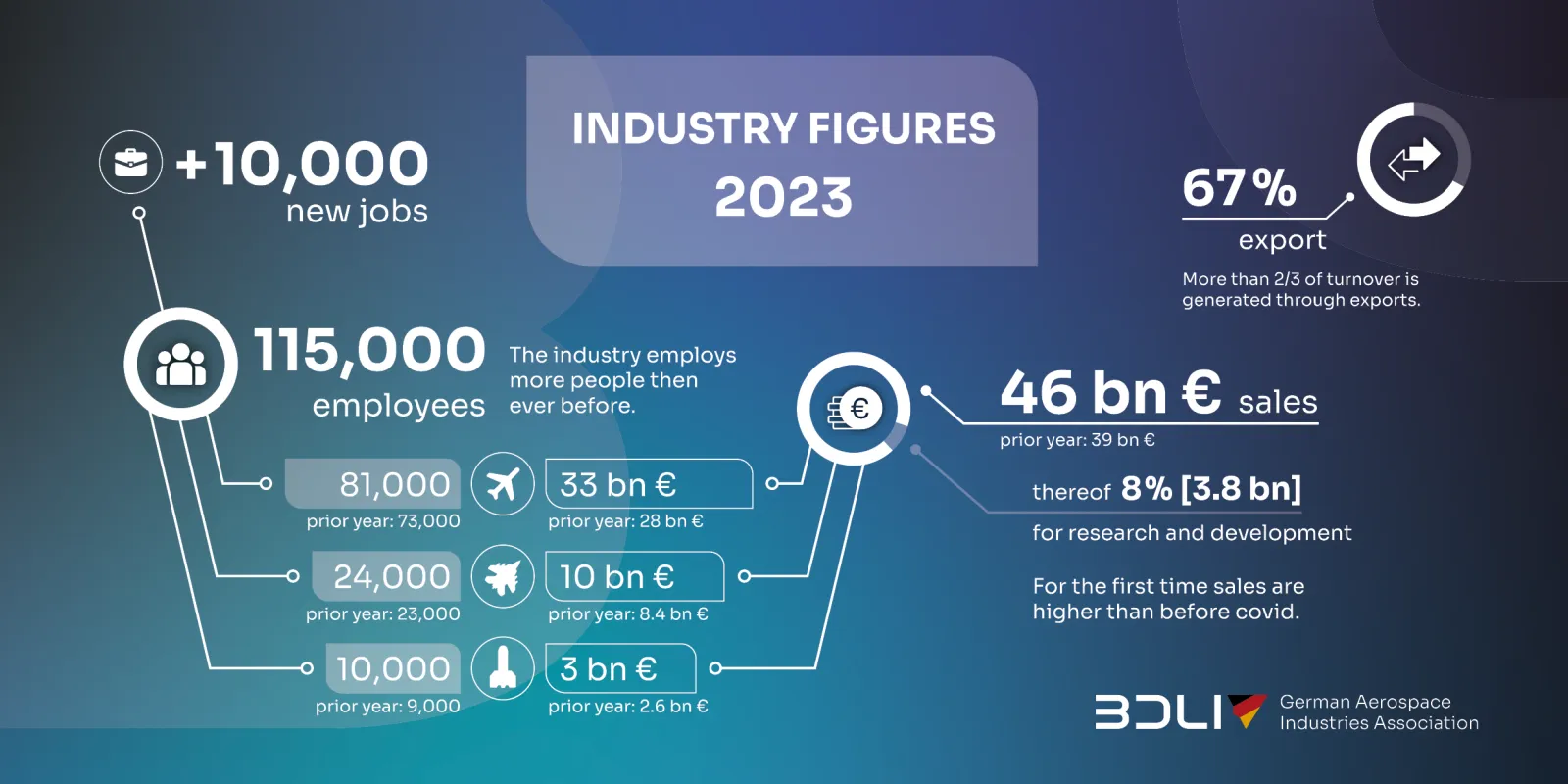

German Aerospace Industry Figures: COVID years behind us, but risks remain

- Total sales of €46 billion in 2023, increase of 18% compared to the previous year

- The sector employs 115,000 people (+10%), more than ever before

- Civil aviation is the main driver, with risks and drawbacks in supply chains and political framework conditions

The German aerospace industry has returned to growth after the COVID years and is employing more people than ever before. In 2023, the industry was able to match or exceed its 2019 figures for the first time.

The figures in detail, with the comparison to the previous year (2022) in parentheses: Total sales amounted to €46 billion (+7 billion / +18%). Of this, civil aircraft construction accounted for 33 billion (+5 billion / +18%), the military sector accounted for 10 billion (+1.6 billion / +19%) and space accounted for 3 billion (+0.4 billion / +15%).

The export ratio is 67% (-5%), while investment in research and development amounts to 3.8 billion, i.e., 8% of total sales (2022: 2.7 billion / 7%).

Germany’s aerospace industry employs a total of 115,000 people (+10,000). Of this, civil aircraft construction accounts for 81,000 (+8,000), the military sector for 24,000 (+1,000) and space for 10,000 (+1,000).

The abundance of orders in civil aircraft construction gives us confidence that this upward trend will continue in the current year 2024.

Figures 2023

At the same time, a number of special factors have led to disproportionately high growth figures for 2023 compared to 2022, the last year of the pandemic – inflation, aid to Ukraine, and the now depleted special fund for the German Bundeswehr had an impact. Taking these effects into account, the increase was mainly driven by the ramp-up in civil aircraft construction.

Dr Michael Schoellhorn, BDLI president, explains: “Industry figures for 2023 feature both pros and cons. We are delighted that our industry has overcome the COVID years and has been able to leave them behind. We also see further growth in both civil aircraft construction and the defense sector. An increasing R&D ratio is further confirmation of our innovative strength.

However, there are significant issues related to supply chain reliability and capacity. Increasing regulatory requirements, such as complex national and European supply chain laws, place additional burdens on companies. And we need reliability and predictability in the growth of the defense budget. Uncertainty in procurement decisions is already threatening manufacturing capacity and know-how, especially in SMEs. It undermines the basic willingness of companies to make upfront investments.

And finally, we are at risk of being left behind internationally in the space sector if we in Europe do not join forces more decisively and recognize and defend the strategic dimension of independent access to space and its use. We need more courageous decisions, from the industry but also from politicians.”

The industry’s continued high rate of reinvestment in research and development (8%) demonstrates that it takes its responsibility for innovation and sustainability seriously. It is a world leader in technology – not many industries in Europe boast that anymore. But to defend this position in global competition, Germany and Europe need the right political framework.